Quantum Computing and Credit Risk Analysis

Whether to buy a home, start a new business or get through college, the ability to borrow money is key to enabling personal and business progress. Credit risk analysis is a key part of the process lenders use to make loan decisions. It basically answers the question “how likely is the borrower to pay back the loan?”

90 of the top 100 largest US lending institutions use The FICO® Score (named after the Fair Isaac Company) for their risk assessment needs. The score, and others like it, consider an individual’s credit history, capacity to repay, available capital, loan conditions, and associated collateral. Though these seem like logical tools to accurately assess a borrower’s financial reliability, low-income communities struggle to obtain capital and grow wealth with this system in place. The existing model of high-interest rates for people with low credit scores has the unintended consequence of keeping poor people poor.

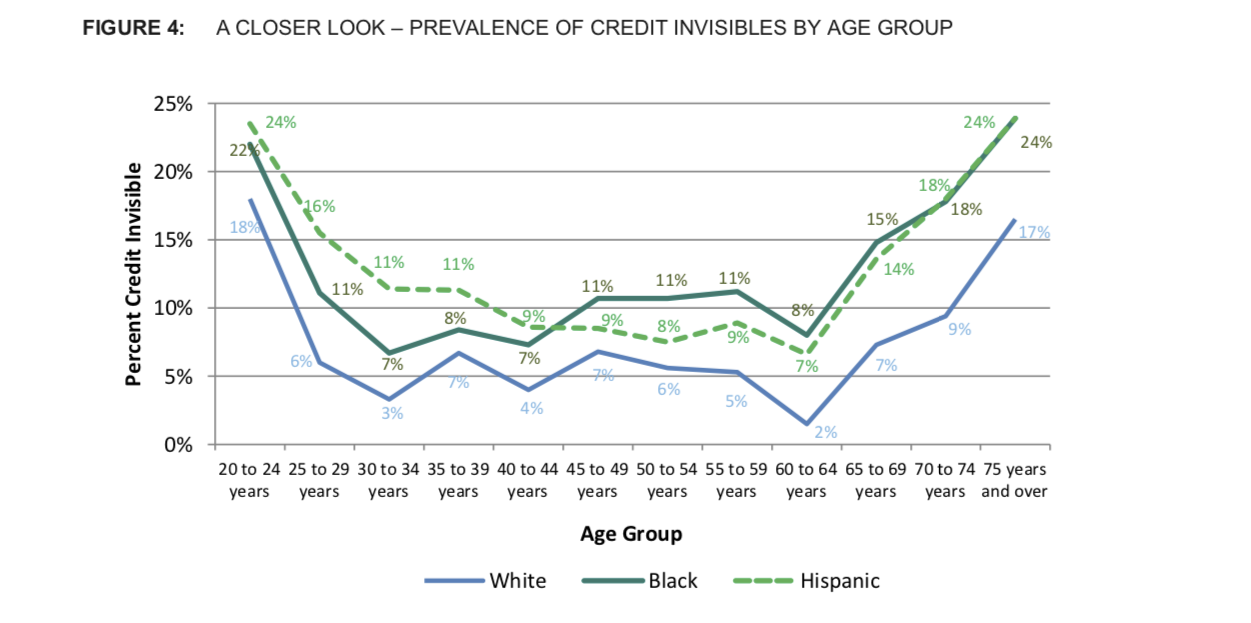

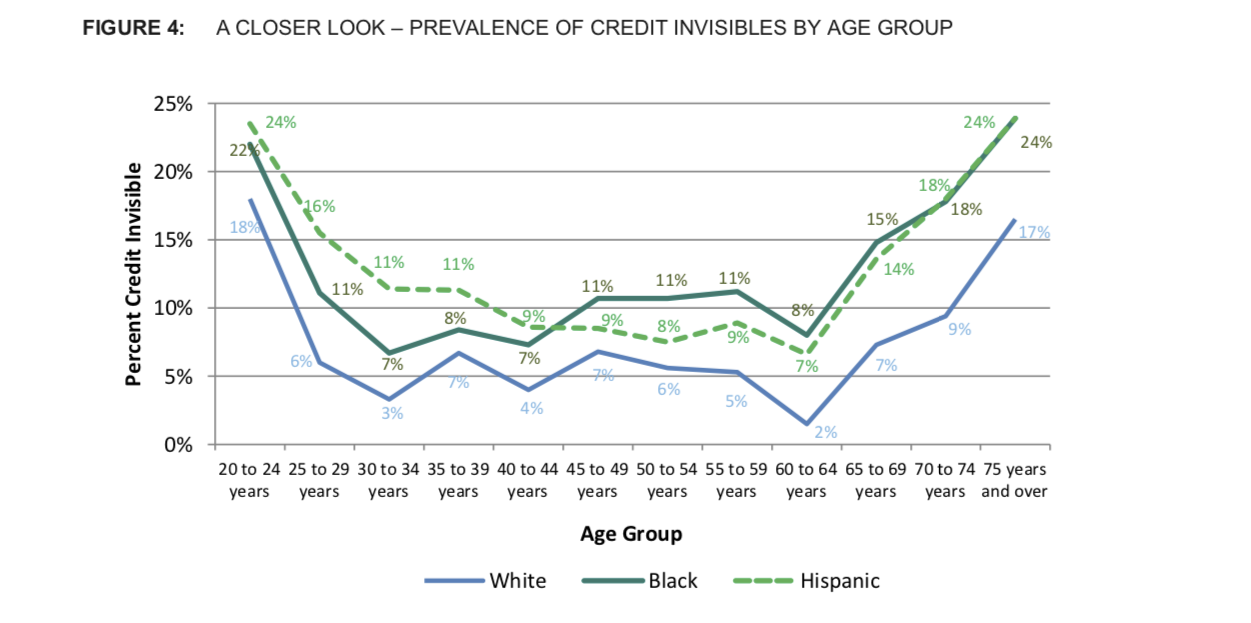

A 2016 report from the Consumer Financial Protection Bureau details the inequality of credit: almost 30% of low-income consumers are credit invisible, or without a credit report, compared with 4% of high-income consumers. This “credit invisible” group mostly consists of young adults just starting out in their financial journeys. The inequality in credit between races can be seen across all ages. For instance, 16% of consumers aged 25-29 years in the Hispanic population are credit invisible, compared to 11% of the Black population and 6% of the White population in the same age group.

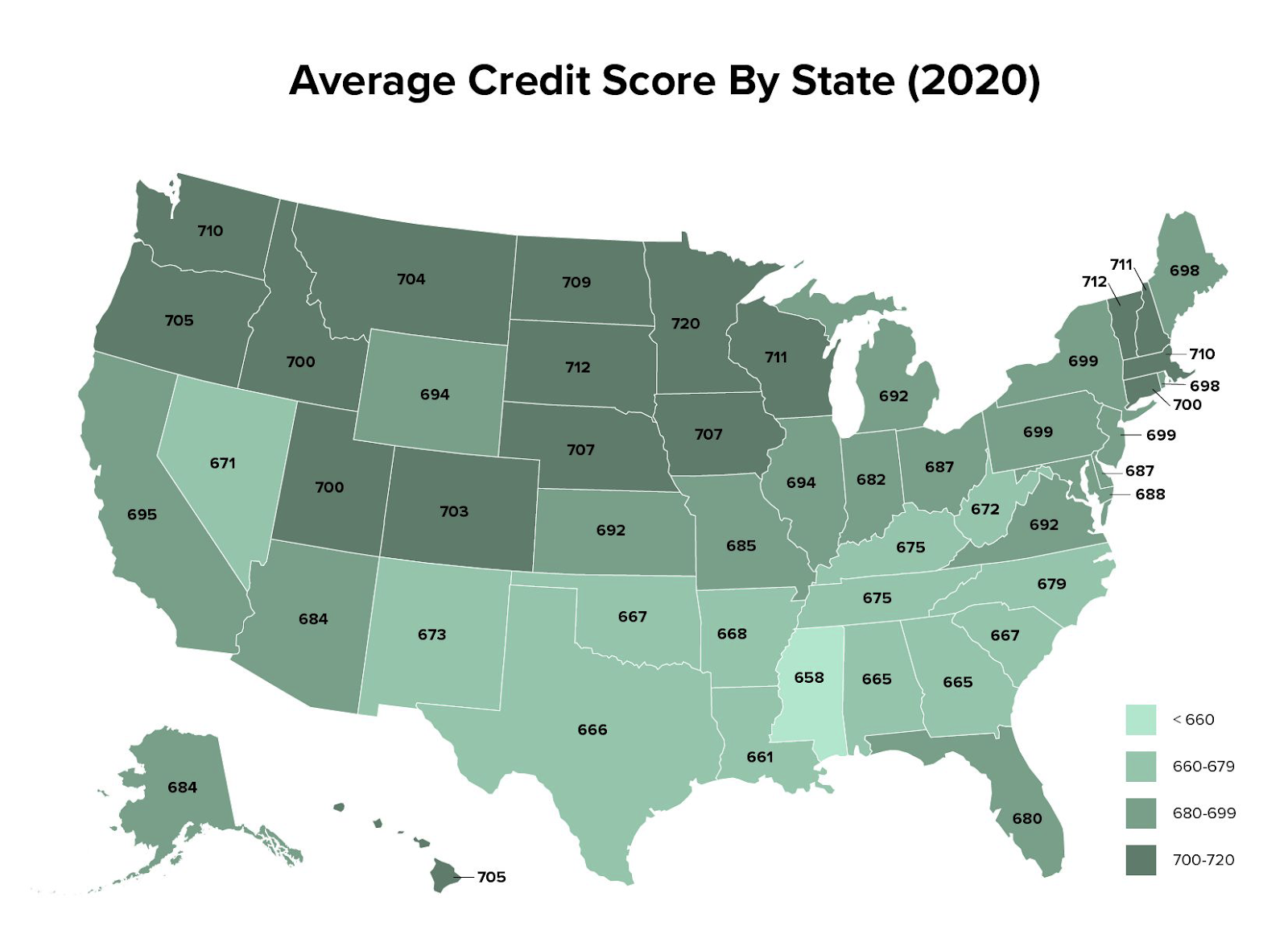

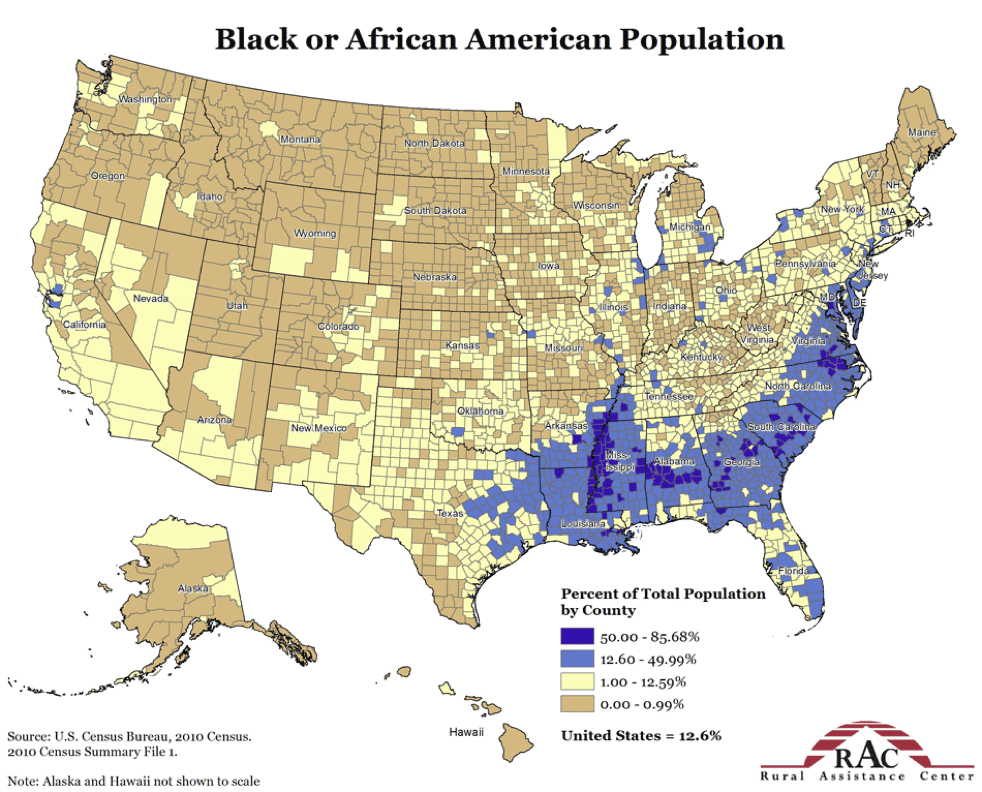

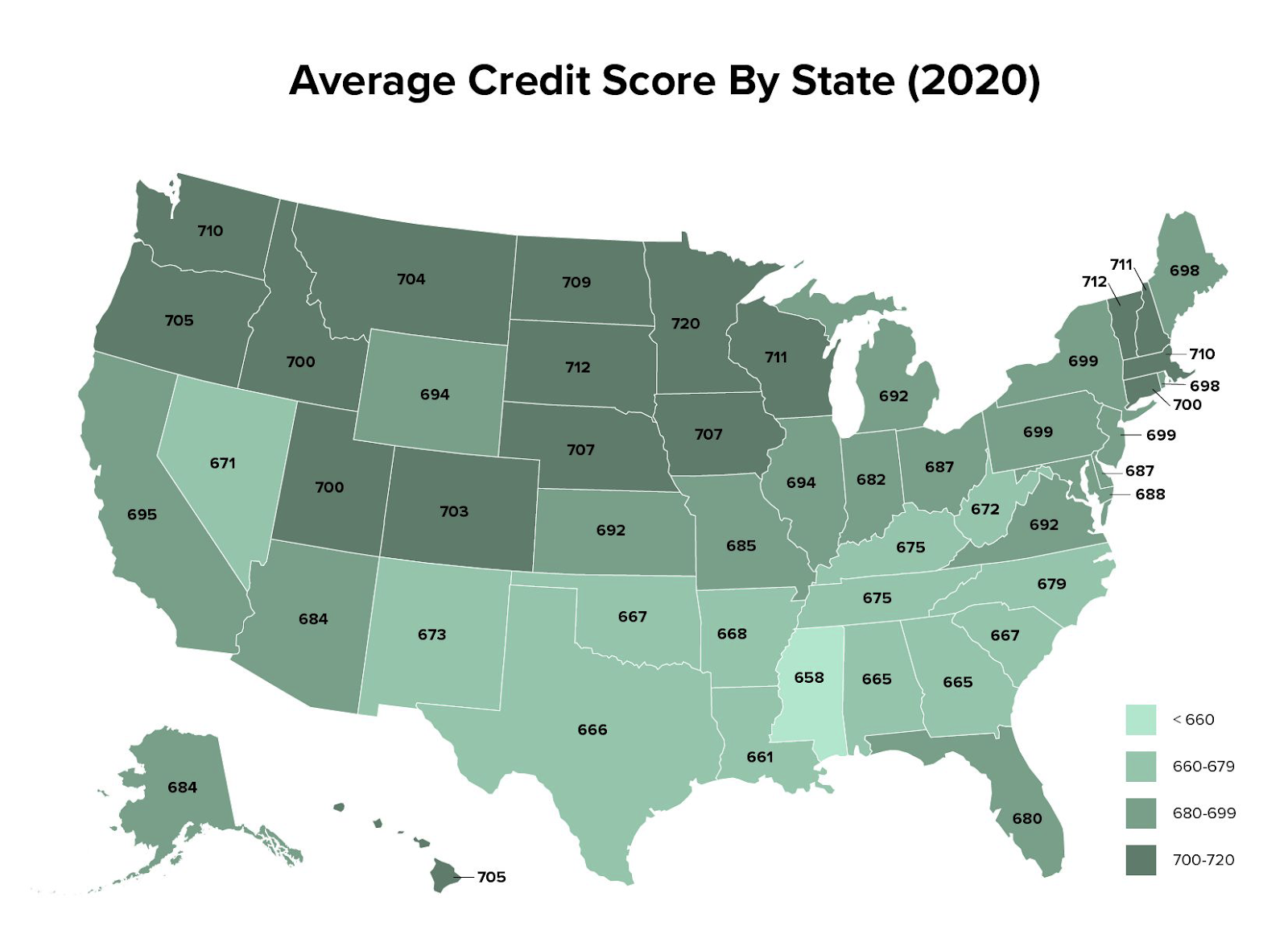

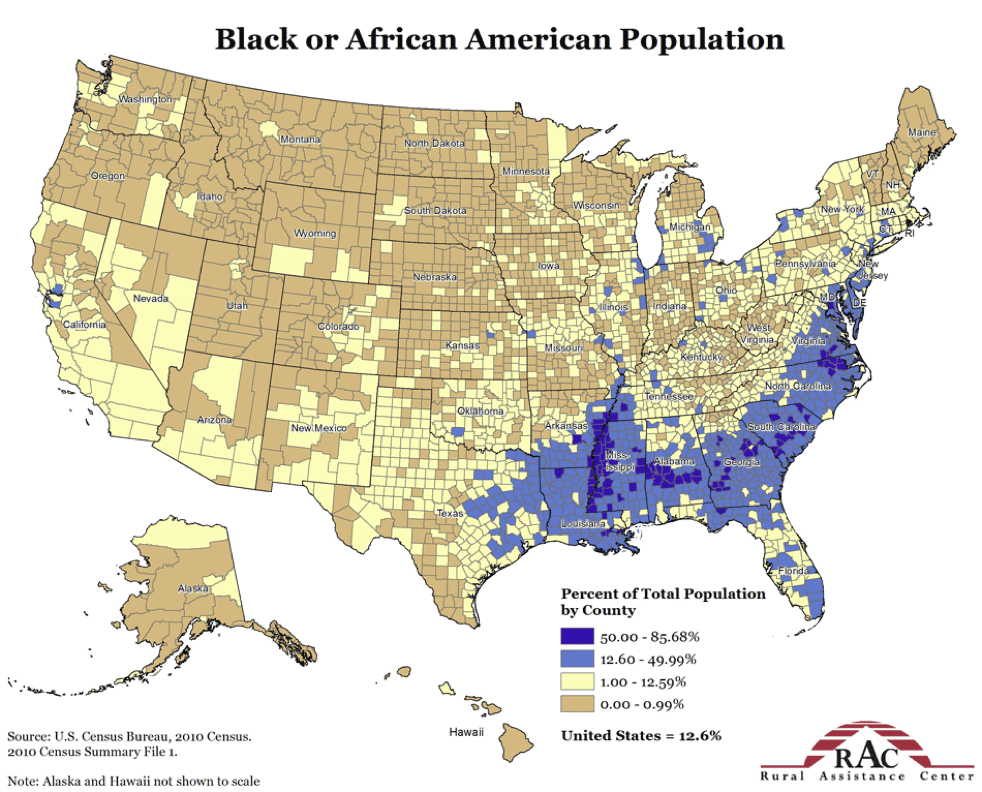

Though the commonly-used scoring systems do not explicitly take the zip code of an individual into account, a consumer’s ability to gain credit is closely correlated with geography. For example, the average credit score of Mississippi residents is 675, while Washington’s is 731. Though a person has no say in where they are born, the birthplace can alter a person’s chances for success or failure.

In order to undo the years of inequalities deeply ingrained in our financial systems, companies and governments need a new method. Many believe that a truly great future must be one with equality of opportunity - one where each consumer is dealt the same hand. Improving the accuracy of risk assessment can contribute to this future, and it does not come at the expense of the lenders. More accurate models could provide new opportunities to lenders, identifying individuals that are credit-worthy and perhaps were overlooked by existing algorithms.

But better algorithms are difficult to develop: the amount of available data is increasing exponentially, much faster than the available computing power.

Quantum computing may be the answer. Existing credit risk analysis algorithms rely on machine learning, but many machine learning algorithms work empirically but have no theoretical proof. It is thus tempting to try quantum heuristics - machine learning models in quantum computers - to uncover new patterns beyond insights gleaned from classical heuristics. Quantum computers have the additional advantages of being able to load data in an exponentially more compact way than classical ones and thus could take many more factors into consideration, such as on-time payments of utility or phone bills, length of employment, acceptance to college, and more.

As Shunichi Amemiya, Head of Research and Development HQ, at NTT DATA, a customer of Classiq says: “We are interested in applying quantum computer technology to financial engineering and believe that the need to compute complex business models will increase in the future.”

It is hard to underestimate the positive societal impact that could result from the use of new quantum computing algorithms. It could give lenders additional confidence to loan money to underserved populations, allowing more people to start new businesses, more young adults to afford college, or more people to afford a good loan to buy the home of their dreams.

Whether to buy a home, start a new business or get through college, the ability to borrow money is key to enabling personal and business progress. Credit risk analysis is a key part of the process lenders use to make loan decisions. It basically answers the question “how likely is the borrower to pay back the loan?”

90 of the top 100 largest US lending institutions use The FICO® Score (named after the Fair Isaac Company) for their risk assessment needs. The score, and others like it, consider an individual’s credit history, capacity to repay, available capital, loan conditions, and associated collateral. Though these seem like logical tools to accurately assess a borrower’s financial reliability, low-income communities struggle to obtain capital and grow wealth with this system in place. The existing model of high-interest rates for people with low credit scores has the unintended consequence of keeping poor people poor.

A 2016 report from the Consumer Financial Protection Bureau details the inequality of credit: almost 30% of low-income consumers are credit invisible, or without a credit report, compared with 4% of high-income consumers. This “credit invisible” group mostly consists of young adults just starting out in their financial journeys. The inequality in credit between races can be seen across all ages. For instance, 16% of consumers aged 25-29 years in the Hispanic population are credit invisible, compared to 11% of the Black population and 6% of the White population in the same age group.

Though the commonly-used scoring systems do not explicitly take the zip code of an individual into account, a consumer’s ability to gain credit is closely correlated with geography. For example, the average credit score of Mississippi residents is 675, while Washington’s is 731. Though a person has no say in where they are born, the birthplace can alter a person’s chances for success or failure.

In order to undo the years of inequalities deeply ingrained in our financial systems, companies and governments need a new method. Many believe that a truly great future must be one with equality of opportunity - one where each consumer is dealt the same hand. Improving the accuracy of risk assessment can contribute to this future, and it does not come at the expense of the lenders. More accurate models could provide new opportunities to lenders, identifying individuals that are credit-worthy and perhaps were overlooked by existing algorithms.

But better algorithms are difficult to develop: the amount of available data is increasing exponentially, much faster than the available computing power.

Quantum computing may be the answer. Existing credit risk analysis algorithms rely on machine learning, but many machine learning algorithms work empirically but have no theoretical proof. It is thus tempting to try quantum heuristics - machine learning models in quantum computers - to uncover new patterns beyond insights gleaned from classical heuristics. Quantum computers have the additional advantages of being able to load data in an exponentially more compact way than classical ones and thus could take many more factors into consideration, such as on-time payments of utility or phone bills, length of employment, acceptance to college, and more.

As Shunichi Amemiya, Head of Research and Development HQ, at NTT DATA, a customer of Classiq says: “We are interested in applying quantum computer technology to financial engineering and believe that the need to compute complex business models will increase in the future.”

It is hard to underestimate the positive societal impact that could result from the use of new quantum computing algorithms. It could give lenders additional confidence to loan money to underserved populations, allowing more people to start new businesses, more young adults to afford college, or more people to afford a good loan to buy the home of their dreams.

About "The Qubit Guy's Podcast"

Hosted by The Qubit Guy (Yuval Boger, our Chief Marketing Officer), the podcast hosts thought leaders in quantum computing to discuss business and technical questions that impact the quantum computing ecosystem. Our guests provide interesting insights about quantum computer software and algorithm, quantum computer hardware, key applications for quantum computing, market studies of the quantum industry and more.

If you would like to suggest a guest for the podcast, please contact us.

.svg)